Managing finances in the healthcare sector can be highly rewarding, especially for physicians who have the potential to accumulate significant earnings while contributing to the well-being of others. Despite the financial rewards, high-income medical professionals, particularly physicians, often grapple with substantial tax liabilities and significant educational debts. Navigating this financial landscape requires strategic tax planning to optimize outcomes and preserve hard-earned money.

Tax planning involves a comprehensive analysis of an individual’s or household’s financial situation with the aim of minimizing taxes within the bounds of the law. Seeking assistance from financial planning services for physicians is a prudent step, as these experts can provide valuable guidance to navigate the complexities of the tax system and identify opportunities for expense reduction. Collaborating with financial advisors ensures a step-by-step approach to financial planning, enhancing the likelihood of achieving long-term financial security and retirement goals.

In addition to seeking professional guidance, there are practical steps that medical professionals can take independently to engage in effective tax planning. Maximizing opportunities provided through employment or other avenues is crucial. For example, taking full advantage of retirement benefits, such as contributing to a Health Savings Account (HSA), can be a straightforward yet impactful measure.

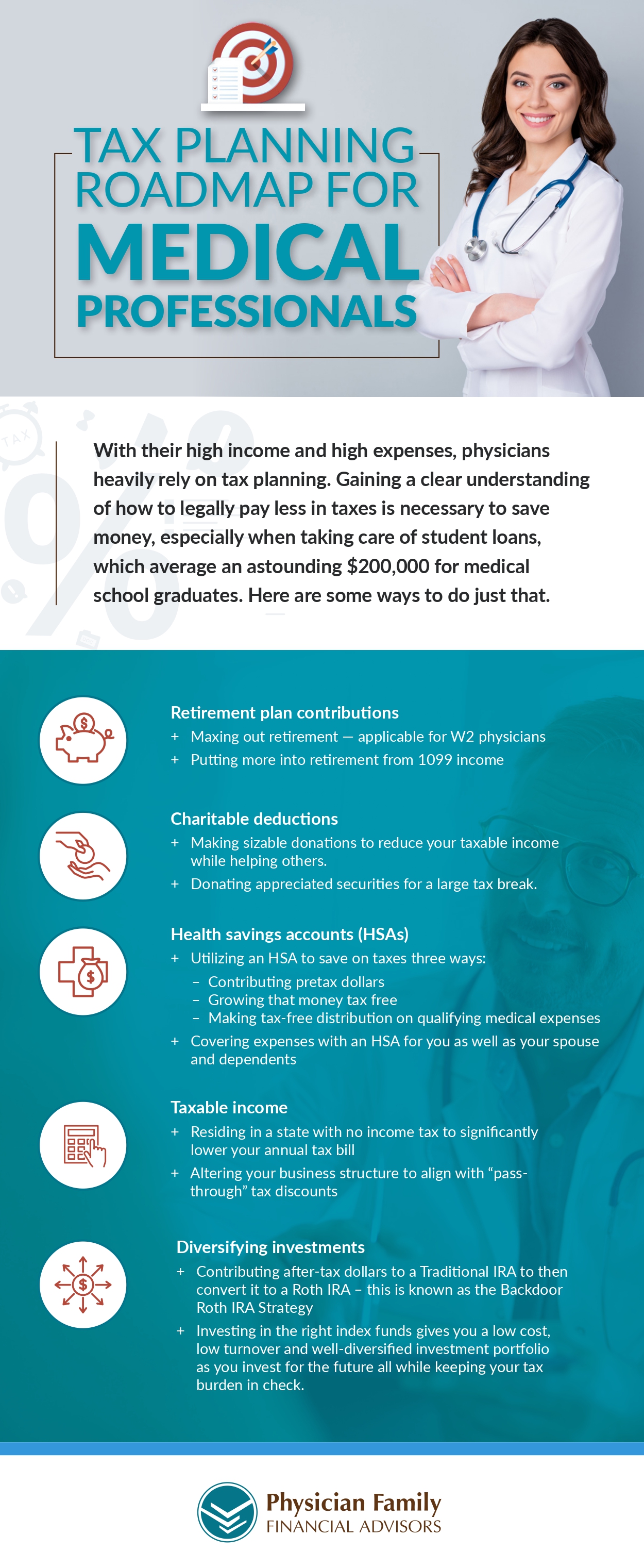

Explore the accompanying resource for more insights into tax-reducing tips for medical professionals, empowering them to make informed financial decisions and secure a robust financial future.

Tax Planning Roadmap for Medical Professionals from Physician Family Financial Advisors, a provider of financial planning services for physicians

Comments